Every patient has a story. The question is, are you—as the provider—telling the most important aspects of it, or are you missing critical details? We’re talking about the details that affect the patient’s health status and predict the resources required to care for them—two pieces of information that play a critical role in risk-adjusted payment models. Here are five questions and answers to consider.

Why does provider documentation matter for risk adjustment?

The provider—through their documentation—tells the patient’s story using the ‘language’ of ICD-10-CM diagnosis codes. Together, these codes create a narrative that includes important diagnostic information. When combined with demographic data and other details, the patient’s health status becomes clearer. Without this narrative, the story is disjointed, confusing, or lost completely. Health plans, CMS, and other treating providers can’t connect the dots when there are only a few dots to connect, or worse yet, a blank page.

If your documentation doesn’t support the ICD-10-CM codes you’ve assigned—or you omit certain codes because no documentation exists—your revenue under value-based contracts could suffer.

Why does coding matter for risk adjustment?

If your coded data indicates subpar performance or that you haven’t met certain performance thresholds, you could be missing out on revenue. Inadequate coding (i.e., missing codes or lack of specificity) also often leads to time-consuming onerous retrospective chart retrieval and reviews as well as compliance risks.

For patients, lack of appropriate ICD-10-CM diagnosis codes can result in poor coordination of care. This is true under all payment models—not just risk-adjusted ones. That’s because documentation and coding are the primary means of communication between care teams. In addition, patients may be omitted from beneficial care management, disease intervention, and other wellness programs if the coded data associated with their records is inaccurate or incomplete. Strong documentation, combined with appropriate ICD-10-CM coding, provides a comprehensive view of the patient. This ultimately helps control the cost of care.

For the purposes of this article, we’ll focus on the Centers for Medicare & Medicaid Services’ (CMS) risk adjustment model.

Not every ICD-10-CM diagnosis code affects risk adjustment under the CMS model. That’s because this payment model excludes diagnoses that are vague/nonspecific (e.g., symptoms), discretionary in medical treatment or coding (e.g., osteoarthritis), not medically significant (e.g., muscle strain), or transitory/definitively treated (e.g., appendicitis).

In the CMS model, those conditions that do affect risk adjustment (which are roughly 10,000 out of 70,000+ diagnoses) are grouped into approximately 1,300 diagnostic groups (DXG) that are then aggregated into condition categories (CC). CCs are related clinically and with respect to cost. Hierarchies are imposed among related condition categories. This mean that a patient is coded for only the most severe manifestation among related diseases. Hence the term ‘hierarchical condition categories’ or HCC. HCCs accumulate among unrelated diseases, and the model accounts for interactions between certain conditions for which costs can be exacerbated, (e.g., diabetes and congestive heart failure).

HCCs paint a complete picture of each beneficiary’s acuity to ensure appropriate and accurate reimbursements, effectively managing costs for high-risk members and delivering high-quality care.

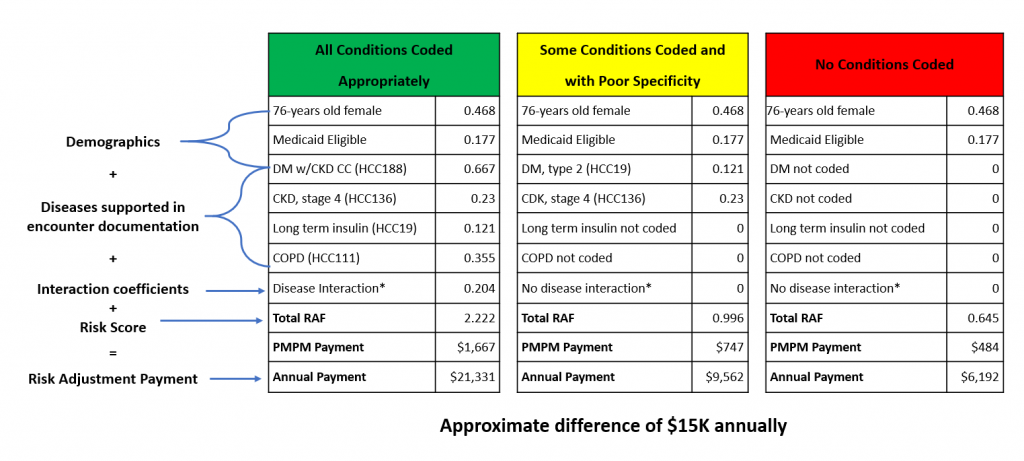

Check out the example below that illustrates a $15,000 difference in payment under the CMS-HCC model based on whether the provider captures these four diagnoses with maximum specificity: Type 2 diabetes mellitus with a manifestation of stage IV chronic kidney disease, long-term insulin use, and chronic obstructive pulmonary disease.

Impact of Accurate Documentation & Code Capture

What are some documentation and coding best practices for busy physicians?

Consider these tips:

- Perform a valid face-to-face encounter. As a result of the ongoing impact of the COVID-19 pandemic, synchronous audio and video appointments are, for the time being, acceptable for the purposes of risk adjustment.

- Use the ‘MEAT’ acronym as a best practice guide for documentation:

- Monitor: Document signs and symptoms as well as any disease progression or regression. Don’t forget to evaluate chronic conditions at least once annually. Also, avoid use of ‘history of’ if the condition remains active.

- Evaluate: For example, document test results, medication effectiveness, and response to treatment.

- Assess: For example document any of the following, when relevant: Ordering of tests, discussion, reviewing records, and counseling. Copying and pasting the entire problem list into the assessment and plan is unacceptable.

- Treat: For example, document any medications ordered, therapies, or other modalities.

- Link diagnoses with manifestations using a linking statement or other document.

- Add all diagnosed conditions to both the chronic problem list and assessment.

- Submit all relevant ICD-10 diagnosis codes, including Z codes.

- Ensure the medical record includes a legible signature with name, date, and credentials.

- Ensure the diagnoses being billed match the actual medical record documentation.

- Always remember the golden rule of medical record documentation: If it’s not documented, it didn’t happen.

How can physicians minimize compliance risk and benefit from risk-adjustment programs?

One way to minimize risk and to actually increase revenue is to participate in a health plan-sponsored risk adjustment program that helps providers tell the patient’s story as accurately and completely as possible—all while minimizing the impact on staff and internal processes.